Salaries of the highest-paid CEOs in France in 2025: Rankings, figures and trends

2025 ranking of France's highest-paid CEOs

In 2024-2025, the salaries of France's top CEOs broke all records: the average compensation of a CAC 40 CEO reached 7.1 million per year, i.e. 150 times average salary and 300 times the minimum wage. At the top, Bernard Charlès (Dassault Systèmes) in;cash close to 46.8 million annual sales, while Carlos Tavares (ex-Stellantis) reached 36.5 millionBut the real surprise lies in their personal fortunes, derived from bonus shares, stock options and a very closed business network: €32 billion for Pinault, 1.5 billion for Charlès... and the gaps are widening all the time.

CEO skills: a more nuanced assessment than it seems

Managing a CAC 40 group is not just a matter of financial KPIs: the quality of the executive committee, governance, the ability to negotiate with the French government and, yes, a touch of luck all make a difference. This complexity explains why we rarely see an "exported" French CEO at the head of an American multinational - networks (alumni of HEC, Polytechnique, ENA) remain the main career gas pedal.

The Wage Surge: From Peugeot Lion to Stellantis Giant

At Peugeot in the 1980s, the boss earned 53 000 € per month; today, Carlos Tavares earns 3 000 000 € monthly, a ratio of 2,100 times WORKER'S PAY. The Stellantis case illustrates a widespread phenomenon: long-term bonuses, cash bonuses and a

ctions make total compensation skyrocket, even when the economy takes a turn for the worse.

Ranking 2025: The 7 Highest-Paid CEOs and Their Fortunes

| Rank | CEO & Group | Compensation 2023-24 | Estimated wealth | Key points |

|---|---|---|---|---|

| 1 | Bernard Charlès - Dassault Systèmes | 46 800 000 € | 1 500 000 000 € | 70 % of performance shares; double-digit software growth |

| 2 | Carlos Tavares - Stellantis | 36 500 000 € | 600 000 000 € | Bonus x 2 despite a 70 % drop in 2024 earnings |

| 3 | Daniel Julien - Teleperformance | 19 700 000 € | 550 000 000 € | Record wage gap: 1,453 × average wage |

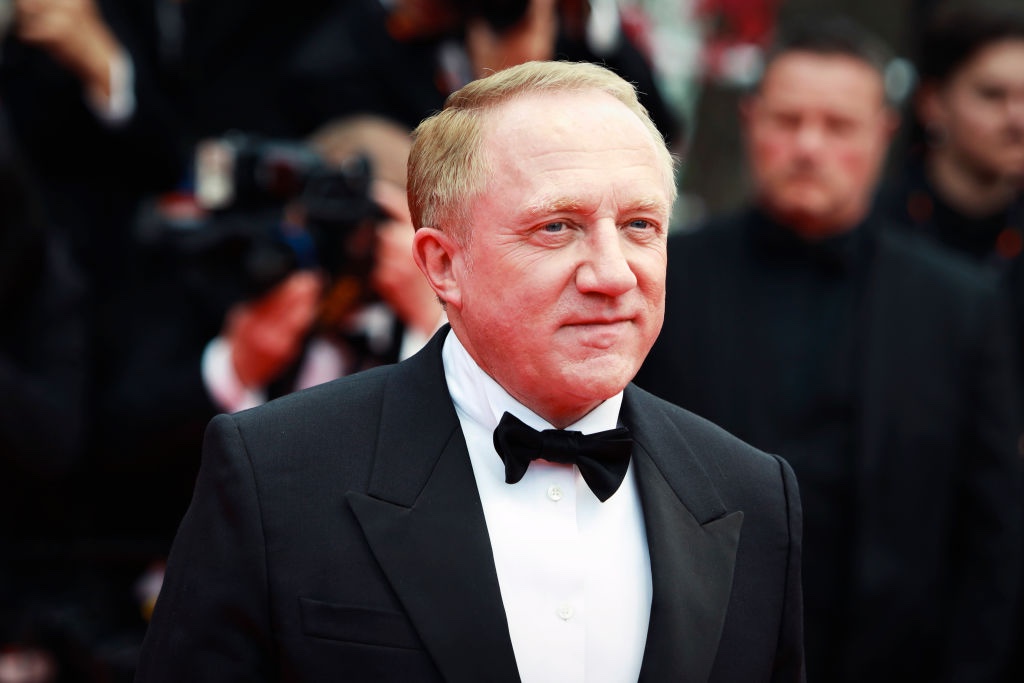

| 4 | François-Henri Pinault - Kering | 13 700 000 € | 32 000 000 000 € | Héritier + Artémis shares, luxury yield |

| 5 | Alexandre Bompard - Carrefour | 3 370 000 € | 150 000 000 € | Variable frozen but major action plan in 2025 |

| 6 | Luca de Meo - Renault | 12 860 000 € | 120 000 000 € | 86 % equity compensation, "Renaulution" Shareplan |

| 7 | Thomas Buberl - AXA | 6 150 000 € | 200 000 000 € | Compensation criticized but variable linked to ROE |

Pourquoi Des Écarts Si Titans?

Variables, Shares & Stock Options

The variable component can sometimes reach 70 % of the package. Financial indicators (EBIT, TSR) with a 1-3 year horizon favor short-term decisions. The result: volatility that can double (or halve) pay from one year to the next, without always reflecting sustainable value creation.

Le Poids Du Réseau

Employers' social minimums are decided among peers: directors, former classmates and headhunters. This co-optation perpetuates high standards and an "entre-soi" attitude that excludes the majority of profiles from universities or medium-sized companies.

France Vs United States

A CAC 40 executive wins 150 times the average salary; an S&P 500 CEO : 300-400 times. US packages often exceed 100 M€through massive stock option plans. This international pressure fuels France's bid to "stay competitive" in the talent market.

CEOs, Founders, Employees: Diverse Realities

A founder-shareholder (Pinault) is enriched above all by capital gains on the stock market; a "pure employee" CEO (Bompard) depends more on his fixed salary and his variable portion; an executive-manager (Charlès) is somewhere in between, thanks to stock option plans. This diversity makes comparisons difficult, but the feeling of injustice remains strong among employees.

Where Does The Money Go?

Political pressure Proposals to cap salaries at 100 × the median resurface with every extravagant pay spike.

Back to Shareholders Buy-backs are breaking records, mechanically boosting the value of stock options.

ESG investments Social and climate indicators: still marginal in bonuses, hence the debate on integrating social and climate indicators.

Frequently asked questions FAQ

How much do France's highest-paid CEOs earn?

CEOs of major French companies can earn several million euros a year. Some CAC 40 bosses exceed 4 to 5 million euros a year. In the highest cases, they approach or even exceed 9 million euros a year.

How have CAC 40 CEO compensation packages varied over the years?

Salaries of CAC 40 executives generally increase every year. In some years, increases exceed 50 % in just a few years. But these amounts can also fall, depending on economic conditions or company performance.

Who are France's highest-paid CEOs?

The ranking of the highest-paid CEOs changes every year. They often include the heads of France's largest companies, especially in the luxury, energy and finance sectors.

Names and rankings vary according to the reports published each year by different consultancies.

What does the remuneration of a CEO of a major French company consist of?

A CEO's compensation generally includes several elements:

- A fixed annual salary

- A performance-linked variable component

- Shares, stock options or benefits in kind

- Sometimes exceptional bonuses

This structure is designed to reward current management and financial success.

Examples of salaries paid to top French executives

| Company | CEO's annual salary (approx.) |

|---|---|

| CAC 40 company A | 5 million euros |

| CAC 40 company B | 7 million euros |

| CAC 40 company C | 9 million euros |

These amounts are indicative and may vary from year to year.

What is the gap between the salaries of CEOs of large companies and those of SMEs in France?

CAC 40 CEOs often earn 100 times more, sometimes even more, than the heads of SMEs.

The big bosses take in several million euros every year.

By comparison, a manager of an SME generally receives between 50,000 and 200,000 euros a year.

Frankly, this gap speaks volumes about the difference in size and economic weight between these companies.

Can a CEO see his salary drop?

Yes: Alexandre Bompard lost 25 % in bonuses in 2024 for failing to meet targets, reducing his pay to €3.37m

Do Shareholders Have a Right To Watch?

Say On Pay" does exist, but it is consultative; few shareholders' meetings reject a package, as boards of directors remain in control.