Collinet family: wealth of €1.9 billion and Carmeuse's leadership in the limestone industry

The Collinet family: Fortune and influence in the limestone industry

Visit Collinet family occupies a leading position in the limestone mining and processing sector, ranking second worldwide after the walloon family Lhoist. With an estimated fortune of over 1.9 billion euros, this Belgian family is one of the most influential in the mining and manufacturing industries.

Carmeuse: the world's leading family-owned company

The history of Collinet family began in the 19th century in the Walloon ArdennesThe company began quarrying limestone. Today, the company Carmeusethe family-owned company, has a significant presence in Europe and North America, consolidating its position as leader in the sector.

Strategic Acquisition and International Expansion

Visit 2008Carmeuse has made a major acquisition with the purchase of the American company Oglebay Norton for 520 million dollars. This acquisition marked a turning point for Carmeuse, strengthening its presence in the US sand mining market. However, as this activity did not correspond to Carmeuse's core business, the company quickly sold this division in 2011, refocusing its operations on limestone.

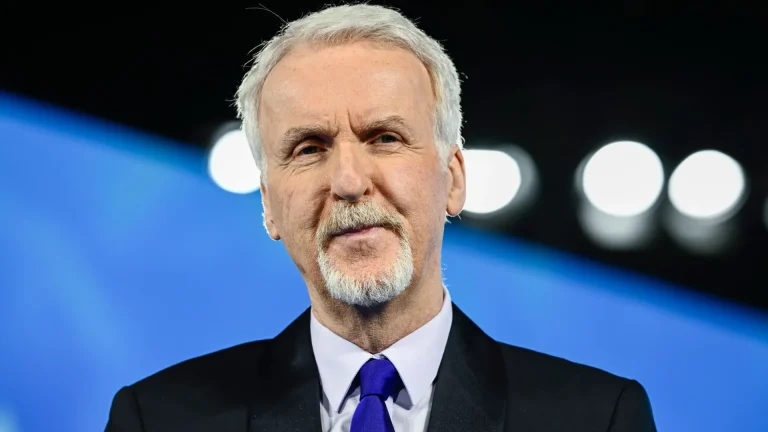

Leadership by Rodolphe Collinet

Under the direction of Rodolphe CollinetCarmeuse has 100 sites including limestone quarries, plants and sales offices throughout 18 countries. In Belgium, Carmeuse operates six production sites. Internationally, Carmeuse has operations in North America (United States, Canada), Western Europe (France, Netherlands, Italy, Spain), Central and Eastern Europe (Turkey, Slovakia, Czech Republic, Hungary, Romania, Bosnia) as well as in Africa (Ghana).

Ownership structure and investments

More 60 % from Carmeuse is owned by Collinet familyrepresenting the fifth generation, with Rodolphe Collinet as CEO. Cobepaan investment company partly owned by Cobeholdhas 20 % de Carmeuse. Cobehold is related to the Spoelberchwhich controls approximately 50 % of this company, reinforcing strategic alliances within the Belgian industrial landscape.

Expansion into emerging markets

Carmeuse has also ventured outside the European and North American markets. Visit 2013the company invested in a limestone mine in Oman as a basis for expansion into the Indian market. Faced with the absence of significant growth prospects in Europe and North America, Carmeuse is now primarily targeting the booming Indian market. At 2016Carmeuse continued its expansion through acquisitions in Thailandand Brazilconsolidating its presence in emerging markets.

Presence and workforce

With a workforce of 4,200 employeesof which approximately 10 % working in Belgium, Carmeuse remains a major player in the limestone industry. The vision of Rodolphe Collinet remains clear: maintain Carmeuse as a family business while expanding into emerging markets.

Conclusion

Visit Collinet familyThis constantly evolving brand illustrates how a traditional lineage can adapt and thrive in a modern environment. With influential leaders such as Rodolphe Collinetand a fortune estimated at over 1.9 billion eurosThe family continues to strengthen its position in financial and industrial markets in Belgium and abroad.

FAQ about the Collinet family

Who is Rodolphe Collinet?

Rodolphe Collinet is CEO of Carmeuse and family leader Collinet. Under his leadership, Carmeuse has consolidated its position as world leader in limestone extraction and processing.

What is the estimated fortune of the Collinet family?

The fortune of Collinet family is estimated at over 1.9 billion eurosThis makes them one of Belgium's richest mining families.

What are Carmeuse's main activities?

Carmeuse is a diversified holding company specializing in limestone extraction and processing. It owns more than 100 sites distributed in 18 countries and manages a significant investment portfolio in European and North American markets.

What was the significance of Carmeuse's acquisition of Oglebay Norton?

The acquisition of Oglebay Norton at 2008 for 520 million dollars strengthened Carmeuse's presence in the US market. However, this division was sold in 2011 to refocus Carmeuse's activities on its core business.

How did Carmeuse expand in emerging markets?

Carmeuse has invested in a limestone mine at Oman at 2013 to position itself in the Indian market. Visit 2016the company continued its expansion with acquisitions in Thailand and Braziltargeting emerging markets with high growth potential.

What is Carmeuse's ownership structure?

More 60 % from Carmeuse is owned by Collinet familywith Rodolphe Collinet as CEO. Cobeparelated to the Spoelberchhas 20 % of Carmeuse, reinforcing strategic partnerships within the industry.