Laurent Levaux: The Strategic Rectifier who orchestrated a 600 million euro sale

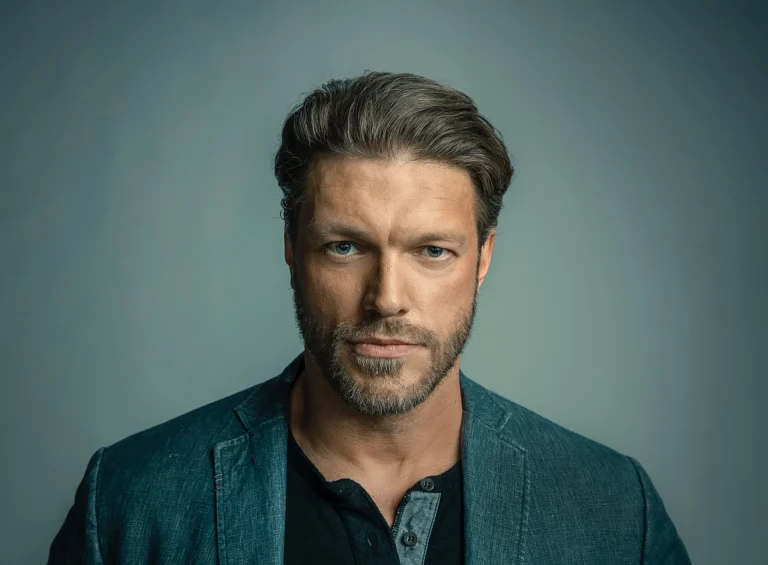

Laurent Levaux

Laurent Levaux began his career with Fétinne/Losfeld, a Liege-based SME, after graduating in applied economics from the Catholic University of Louvain. Enriched by an MBA from the University of Chicago, he then returned to Belgium, where he worked for a number of years. ten years as a consultant with McKinsey & Co. Levaux went on to distinguish himself as a crisis manager at Cockerill Mechanical Industries (CMI), making the company autonomous and profitable. Laurent Levaux has a fortune of over 47 million euros.

In 2003, he was recruited to turn around ABX, an SNCB subsidiary. specialized in logistics. Under his leadership, not only ABX returns to profitabilityBut within two years, he completed the sale of the company for an impressive 600 million euros, causing quite a stir politically. Following this operation, Levaux and the 3i investment fund invested in Aviapartner, the airport handling specialist, where Levaux took over as CEO. Under his leadership, Aviapartner implemented strategies to divest some of its cargo handling activities, notably at Paris CDG, Frankfurt, and Schiphol.

In parallel with his responsibilities at Aviapartner, Laurent Levaux has held various positions in leading companies such as Proximus and Bpost. As Chairman of the Nethys Board of Directors, He has also played a key role in the company's governance. His contributions also extend to entities such as FN Herstal and UWE.

During his tenure at Aviapartner, Levaux succeeded in stabilizing and restructuring the company's operations, although some divestment attempts, such as that of Brussels Airport, were unsuccessful. Levaux's role in crisis management and strategic direction was marked by significant successes despite economic and political challenges.

Over the years, Levaux has accumulated a number of executive positions and board seats, confirming his ability to manage companies in sectors as varied as aviation, logistics and postal services. This diversified experience has enabled him to build up a wide professional network in Belgium and beyond, while affirming his reputation as an effective and determined strategist.

Companies and Key Roles:

- Aviapartner: Former CEO, majority shareholder

- Proximus: Director

- Bpost: Former Director

- Nethys: Former Chairman of the Board of Directors

- FN Herstal: Board member

- UWE: Chairman

Education and Professional References:

- Catholic University of Leuven: Bachelor's degree in applied economics

- University of Chicago: MBA

- McKinsey & Co: Management Consultant

Sector Contribution:

- Aviation and Material Handling: Management and strategic restructuring.

- Logistics: Recovery of the ABX.

- Postal and mobile services: Governance of key national companies.

This track record demonstrates Laurent Levaux's ability to adapt, evolve and effectively transform the companies he manages, and has created assets worth over 45 million euros.